ACA Employer Compliance in 6 Easy Steps

The Affordable Care Act’s employer mandate kicked in a year ago on January 1st, 2015, ringing in the first calendar year that many employers had to start sponsoring appropriate employee health care coverage and documenting it. It was all in preparation for new IRS documents to be led by companies at the top of this year. Not unlike ling your own personal taxes every year, all of this new ACA compliance feels a bit stressful, daunting, and—in short—a drag.

Section 6056 of the Internal Revenue Code now requires employers to report their employee health insurance offerings. Accordingly, penalties for insufficient coverage are already in effect for the 2015 plan year for companies with over 100 full-time employees.

But don't worry. There's good news. We're here to help.

We've outlined 6 easy steps to get you on your way to ACA compliance:

- Determine how many full-time equivalents you had in 2014.

- See if you qualify for transition relief.

- Make sure the health plans you offer is affordable.

- File forms 1094-C and 1095-C, and send written statements to all covered employees.

- Steer clear of penalties.

- Get all of the help you need.

Combined with an HR solution for tracking all of your employees' payroll information—and some aid with reporting your forms—you'll be well on your way to keeping your health plan documentation spic and span.

But let's not get too ahead of ourselves. We'll start by getting you and your company compliant. Let's start making the ACA as easy as A-B-C.

1. Determine how many full-time equivalents you had in 2014

ACA Acronyms:

- ACA: Affordable Care Act

- ALE: Applicable Large Employer

- FTE: Full-time Equivalent

The ACA’s new employer mandate applies to ALEs— Applicable Large Employers. First, you’ll need to determine if you were an ALE in 2014 to see if you’re responsible for complying with the ACA for the 2015 calendar year.

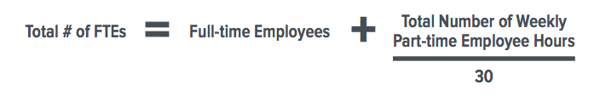

Currently, the magic number of full-time equivalents (FTEs) to classify you as an ALE is 50. Now, as for the de nition

of FTEs. A full-time employee works 30 or more hours per week on average, or about 130 hours per calendar month. That counts as one FTE. Furthermore, part-time employees must also be added to your FTE calculation.

Take the total number of hours worked per week by all part-time employees and divide it by 30 to determine the additional number of full-time equivalents you must add to your calculation.

Now, there are two more classes of employees to be aware of: variable hour and seasonal employees. Variable hour employees are those for whom you can’t determine their weekly hours in advance—their schedule may always change. They are classified as either ongoing— having worked for the company for a consecutive period between three and 12 months—or new.

Seasonal employees begin work at about the same time every year, and their annual employment does not go over six months. These separate definitions can get a little sticky, so consult with your tax advisor if you have many variable schedules for your workforce. Questions 4 and 54 on the IRS Questions and Answers page also o er some clarity.

Once you have your FTE count, then it's full steam ahead.

-

If your company had 1-49 full-time equivalents in 2014, good news! You’re not required to comply with the ACA employer mandate. If your medical plan is self-insured, though, you will still need to provide form 1094-B to the IRS and 1095-B to covered employees.

-

If you had 50-99 full-time equivalents in 2014, the ACA employer mandate does apply to you. But, you may qualify for transition relief.

-

If your company had 100 or more full-time equivalents in 2014, the ACA employer mandate applies to you.

-

Have had health care o erings for 70% of your full- time employees in 2015 (now 95% for 2016), as well as employees’ dependents up to the age of 26.

-

Report this information to the IRS via two new forms, the 1094-C and 1095-C, beginning this year.

2. See if You Qualify For Transition Relief

As we mentioned earlier, if you had 50-99 full-time equivalents in 2014, the ACA employer mandate does apply to you. But, the following three conditions may qualify you for transition relief. Here are the three conditions, and check out more information on transition relief via the IRS website:

1. Limited Workforce Size: On business days during 2014, you must have employed at least 50 full-time employees (including full-time equivalents), but fewer than 100.

2. Maintenance of Workforce: If you reduced workforce size or overall hours of service of employees between February 9, 2014 and December 31, 2014, it had to be for a bona de reason, not just to qualify for transition relief.

3. Maintenance of Previously Offered Health Coverage:

Through February 9, 2014 and December 31, 2015, your company must not eliminate or materially reduce health coverage.

So, if your company’s the right size, you’re maintaining health coverage, and you’re not reducing workforce just to avoid the employer mandate, you won’t have to pay penalties to the IRS for 2015 (Note that the IRS often refers to penalties as “payments,” or “Employer Shared Responsibility payments”).

3. Make Sure the Health Plan You Offer is Affordable

According to the IRS, employers can determine if the health plan they o er is a ordable by use of one of three safe harbors. They’re measuring sticks, essentially, to see how far your plan goes.

For the safe harbors, take a look at your lowest cost, minimum value, self-only employee plan, and make sure it does not exceed 9.5% of:

-

The employee’s W-2 wages from the employer for the calendar year

-

An amount equal to 130 multiplied by either the employee’s hourly rate of pay as of the rst day of the coverage period, the lowest hourly rate during the calendar month, or 9.5% of the employee’s monthly salary for salaried employees

-

The federal poverty level for a single individual

4. File Forms 1094-C and 1095-C, and Send Written Statements to all Covered Employees.

On to the actual forms you’ll have to file. Here’s where things really get fun. Think of these as your new W-2s for documenting health care coverage.

Let’s start with the 1094-C, a transmittal form that will cover the following for each month during 2015, all in one form:

-

Your number of full-time employees

-

Your total headcount

-

Any Minimum Essential Coverage (MEC) your company offered

-

Whether a 4980H safe harbor was used during each month. For more info, check out this IRS page.

Next is the form 1095-C. It’s an information return furnished to each employee that reports:

- Proof of coverage offerings by means of a required code

- The employee's share of the lowest cost monthly premium

- Whether a 4980H safe harbor was used during each month

- Any self-insured covered individuals, as applicable

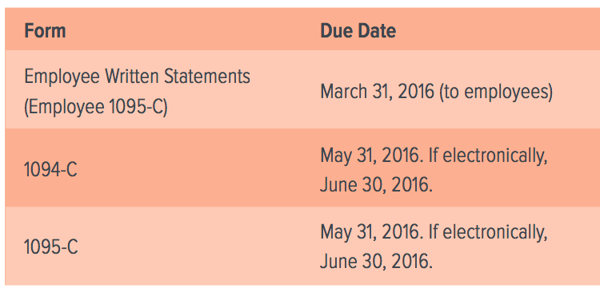

Employees must receive their copies of form 1095-C by January 31, 2016. As goes for the 1094-C, the IRS must receive the 1095-C form by May 31, 2016. If you file electronically, you have until June 30, 2016.

And finally your company must provide a written statement to each covered employee. It must either be a copy of form 1095-C, another form the IRS designates, or a substitute form. It can also be combined with other tax information like the W-2 or 1099. The written statement must include:

- The employer's name, address, and IRS-given EIN number

- The information required to be shown on the section 6056 return for that specific employee

Your employees must receive their written statements no later than March 31, 2016.

5. Steer Clear of Penalties

Remember, all of this paperwork is just the way the IRS enforces the ACA. It’s an effort to lower the number of uninsured people in the U.S. and encourage employer- sponsored health care benefits. Accordingly, there are penalties for the required companies that don’t comply.

Here are those paperwork due dates once again. You have some time, and you’ll avoid penalties by abiding by them.

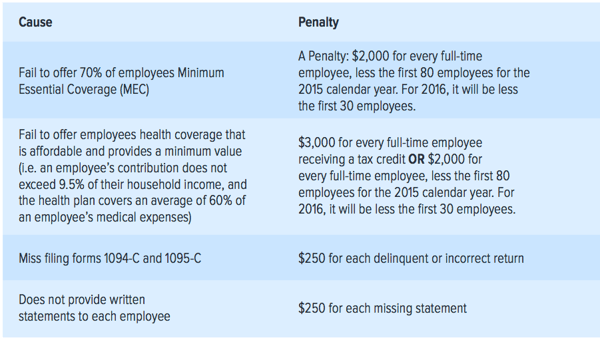

Not to get all doom and gloom, but here’s a quick sum-up of the fines companies can face without compliance. As mentioned, if your company has 100 or more FTEs, these are already in effect for the 2015 calendar year. If you have 50-99 FTEs, these will be in effect for the 2016 plan year.

Your company can only be subject to the A or B penalty—not both. First up is the A penalty: if you are offering MEC coverage to fewer than 95% of your employees, you must pay $2,000 for each one. However, for 2015, you can subtract the first 30 employees from your payment. Visit the IRS website for more information.

But just providing MEC doesn’t block you from penalties altogether. You’ll be hit with the B penalty instead if your coverage is not affordable or does not provide minimum value.

Furthermore, if you miss some of the essential paperwork documentation, you’ll face a $250 payment for each missing statement—and those can add up quickly.

See the sum up of employer mandate penalties below, and avoid burning some cash.

6. Get All Of The Help You Need

Yowza. Staying ACA compliant is complex, and those are some hefty penalties. But get this: there’s actually short-term relief from reporting penalties if ALEs can demonstrate that they put forward “good faith efforts to comply with the information reporting requirements.” Due diligence is getting its due.

Those “good faith efforts” come in a myriad of forms.

- Keep detailed and accurate payroll to meet your MEC thresholds—and avoid those pesky penalties.

- Track your employee's hours to a T with time and attendance, so you know exactly how many FTEs you have at all times.

- Don't just get your employees MEC—get them the benefits that make them happy, and stay compliant with the ACA when doing so.

Dedicated customer support specialists are an important feature of any solution provider. Get the help you want and the information you need to stay on the right side of the ACA.

As your company grows, don't let health care documentation get out of hand. You don't need to face ACA compliance alone.