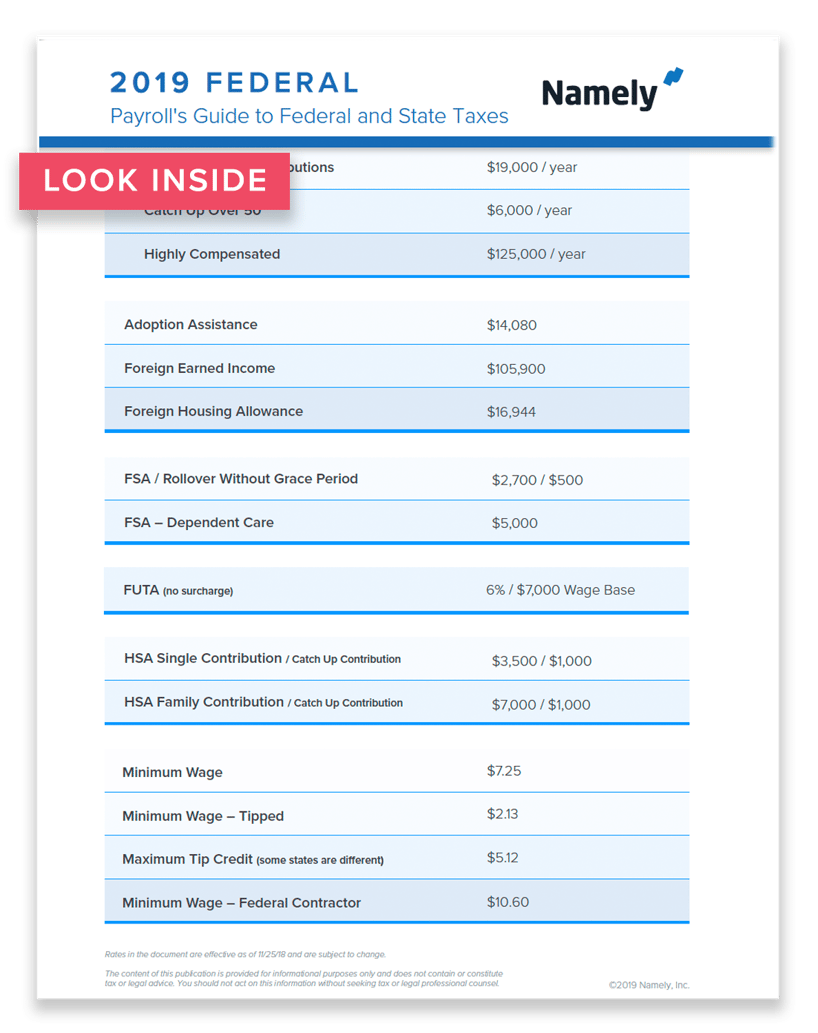

Payroll's Guide to Federal and State Taxes

Your state-by-state fact sheet for minimum wage rates, maximum 401(k) contributions, and more.

GuideDownload Now

It’s not the flashiest part of your job, but it’s core: payroll. Paying your people accurately is the bare minimum employees expect—and unfortunately, it's also one of the most administratively challenging things to get right. Among multistate employers, tax and payroll compliance ranks as the hardest part of HR’s job.

Why? Between minimum wage rates, contribution limits, and wage bases, there are a lot of variables to keep track of.

That’s where our new guide comes in. Whether you need to look up a federal contribution limit or state minimum wage, consider this your “cheat sheet” for all things payroll and taxation. Don’t worry, your secret is safe with us.

Get the latest news from Namely about HR, Payroll, and Benefits.

Thank you

We send out emails once a week with the latest from the Namely Blog, HR News, and other industry happenings. Expect to see that in your inbox soon!