The Ultimate Guide to Multi-state Employment

Navigating HR's Legal and Practical Challenges

Becoming a multi-state employer is a turning point in your company’s history. Few businesses make it this far; for leadership and regular employees alike, the decision to expand is reason to celebrate and look to the future.

HR employees, on the other hand, may be apprehensive about the compliance and practical challenges. Navigating new and sometimes conflicting overtime laws, handling multi-state payroll, preserving a cohesive culture—just a smattering of the issues HR has to face.

Your team can rise up to the challenge. This guide will outline the hurdles multistate employers face and help you reaffirm HR’s strategic role in the organization. With this game plan in hand, you can do this!

Get Involved Early

The decision to open a second office shouldn’t be taken lightly. HR, the department that will ultimately make much of this a reality, needs to be involved from the get-go. If you’re looking for an opportunity to demonstrate HR’s role as a strategic partner, look no further.

As your company’s in-house talent expert, you’ll be expected to help with salary benchmarking and recruiting. If the plan is to stock the new office with web developers, for example, ensure that the cities you’re evaluating actually have the right workforce on hand. If the new office will be staffed with sales people or workers who need to travel often, for example, make sure it’s near a transportation hub.

What kind of benefits do employees expect? While every employee has his or her own unique needs, there are a number of generally agreed-upon “must haves” in the modern workplace.

The cost of paying these new hires will also need to factor into leadership’s discussions. Depending on your industry, employee compensation can account for40 to 80 percent of a company’s overall spending. That’s outside of the very practical expense of just keeping the lights on; rent, utilities, and furnishings will also eat up a sizable part of your budget. The toll of these costs will vary widely across the country —compare living expenses and average salaries in the markets being considered.

With HR fully engaged in the decision to open a new office, your input could save your team, and the company, from making a multi-million dollar mistake.

Multi-state Compliance

Compliance: while it’s the bread and butter of the HR profession, managing it can be a headache. Keeping pace with one state’s labor regulations is easy enough—the trouble starts when other states and cities are thrown into the mix. If you’re launching an office in a regulatory environment as complex as California’s, that’s doubly true.

Compensation and Payroll Taxes

Since 2009, the national minimum wage has been set at $7.25 per hour. That number establishes a national baseline, but many states and cities have set their own, higher rates. Those increases don’t just impact the lowest earners; raising the wage floor overall forces even higher salaries upward.

When opening a new office, particularly in a city with a higher cost of living than in your headquarters’, take heed—minimum wages can reach up to $15 per hour in some jurisdictions. Not only will you have to adjust pay to meet those requirements, you’ll have to exceed them to stay competitive and meet compensation benchmarks.

In addition to compensation, you’ll have to manage state taxes, too. Each state has its own unique deduction rules and income tax brackets. If you have employees who will live and work across state lines, you’ll also need to be mindful of reciprocity rules—that is, whether you’re required to deduct income taxes from both states.

Because these rules vary widely, a good starting point is to call your state’s department of finance or labor. While they’ll be able to advise you on local obligations, implementing that advice may pose another challenge. For most HR departments, scrappily managing payroll with spreadsheets becomes untenable after adding multi-state compliance to the mix.

Overtime

Even something as straightforward as overtime can become convoluted: 19 states have drafted their own overtime rules. The US Department of Labor and most states define overtime work to be anything beyond 40 hours a week. Alaska, California, and a few others look at it differently. They’ve adopted the day-by-day model, meaning time and a half is due for any work over 8 hours a day. In California, double pay is due for any work over 12 hours.

See how easy-to use HR technology makes keeping track of employee hours effortless.

While the national Fair Labor Standards Act (FLSA) establishes that no one earning less than $35,568 can be exempt from overtime, some states have gone beyond that number significantly. In New York, the minimum salary for overtime exemption is $46,020 in most counties, but New York City has an even higher threshold at $58,500.

Some states take an entirely different approach. In Hawaii, local overtime rules don’t apply to salaried workers earning over $2,000 a month. In Wisconsin, that threshold is $700 a month. Interpretations of the duties test vary as well. In Colorado, an executive needs to dedicate at least 50 percent of their time to supervisory duties to be considered exempt.

It’s a lot to take in—need a break? Don’t forget to that the rules covering required lunch and rest breaks vary significantly from state to state, too.

Employee Leave, Time-Off

The Family Medical Leave Act (FMLA) entitles workers to 12 weeks of job-protected, unpaid leave for certain medical and family reasons. That’s a federal requirement that sets a national baseline. Several state governments have gone further than that, and if the last decade is any indicator, many more will continue to do so in the near future.

Depending on your company size (some state programs apply only to businesses with 50 or more employees), you may be required to offer as much as 12 weeks of paid leave to employees. States differ in their definition of a qualifying event—some extend leave only to new mothers or individuals recovering from an illness, while others grant it for a range of issues. In some jurisdictions, you can take leave to care for a loved one or to relieve pressure when a family member is called into military service. States and cities are increasingly granting new fathers access to the benefit, too. The amount you are required to compensate employees varies from state to state, and even from city to city. but most programs are paid for by the state and funded through a recurring payroll tax.

Struggling to keep up, some employers have adopted blanket, “unlimited” paid time off programs. While compliant in many states, the tactic has recently come under fire from some labor departments. Because accrued vacation days are typically tied to a monetary value, terminating employees can “cash in” on their remaining time off. An employee’s right to do so has been enshrined in some labor statutes, most notably in California.

Everything Else

Did you know that it's unlawful in Massachusetts to ask about a job applicant’s salary history during the interview process? Or that your company’s firearm policy (if it even has one) may be in violation of Texas state law? Do “ban the box” laws keep your recruiting team up at night? There’s a wide range of unique laws that HR professionals need to be mindful of before making the jump across state lines.

Be sure to consult with an employment law attorney who actually practices in the state you’re moving into. You’ll need someone to help you navigate through some of the quirkier rules and hidden pitfalls employers face. It’s an added cost, but worth it in the long run.

When Laws Contradict

As you’ve learned, the standards for paid leave, wages, and overtime vary widely from state to state or from city to city. When compared to federal requirements, some local rules demand more from employers—others not as much. How do you proceed when laws contradict each other?

There’s one steadfast rule to navigating these legal and HR compliance hurdles: when in doubt, the measure most generous to the employee prevails.

In most instances, federal rules should be seen as baseline requirements — and then local rules, which often build further, win out. Take New York’s new overtime rules, for example. While the federal minimum salary threshold for overtime exemption is $35,568, the state’s is much higher: up to $40,924, depending on what county you’re in. Always be sure that you’re meeting state and city requirements before considering yourself totally compliant.

Local rules aren’t always more generous, though. Let’s say you’re opening an office in Atlanta. The legal minimum wage in Georgia is $5.15, but the national minimum wage is $7.25. Because the federal minimum is more generous to the employee, that rate overrides the lower state minimum. Because of that dynamic, Georgia’s minimum wage is actually $7.25 in practice.

HR Practice

It’s an adage that rings true even for single state employers: HR compliance is hard enough, but it’s the human element that makes things interesting. Maintaining a cohesive company culture when your new satellite office is 2,000 miles away can be daunting even for a seasoned professional. Technology can lessen much of the burden, but it will take organizational and leadership skills to meet the challenge.

Culture

You’ll need HR physically present on opening day, not only for operational purposes, but also to build and maintain your culture from day one. Having an onsite presence makes a world of difference in steering how the office’s culture evolves. At a bare minimum, this means you’ll have to budget for members of your HR team to travel to the office on a continual basis: frequently at first, periodically later on.

Depending on the office’s size, you may need to consider hiring a new, full-time HR team member. The average HR-to-employee ratio for a 250 person company is 3.4. Even if that number correlates with your company’s size, consider how employees will be geographically distributed long term. If your new office will account for at least a third of your employee count, then hiring a local team member may make the most sense. This is particularly true for new offices with big aspirations, as you’ll need a recruiting presence on the ground.

Your first hiring decisions at the new location have a disproportionate impact on its culture. Even in a well-established office, getting “culture fit” wrong can cost your company up to 60 percent of that individual's salary. That expense is only compounded when you consider how it can delay efforts to get a new office up-and-running. Clearly articulate to your candidates what your company’s values and norms are. Budget permitting, fly them out to company headquarters to tour the office and meet with potential coworkers. Remember, these individuals will likely be involved in interviewing other candidates for you, so hire someone you feel confident can act as a cultural “gatekeeper.”

The element of risk goes both ways, as candidates may be just as skeptical of you as you are of them. It’s time to get scrappy: recruiting for a new office is in many ways like hiring for a start-up. Scour your personal and professional networks. Those connections, whether they're direct or through others, can help establish that trust from the get-go. Incentivize other employees to join in the search by setting up a referral program. Don’t be afraid to involve the CEO in the first few interviews. Doing so will show the candidate that leadership is invested in the success of the new office, and that this isn’t just a short-term experiment in a new market.

Once you start hiring, don’t be surprised if the new office develops its own style. While you want to preserve an overarching culture based on your corporate values, “subcultures” always exist. Regional differences inform how people interact with one another, and every major city is known for its unique character. Workplace studies have revealed some of these generalizations are actually credible: East Coast workplace culture ranked as particularly business-oriented and assertive, while the West Coast was found to be more laid back and creative. Don’t sweat these differences—in the long run, these are the quirks that will make your workplace all the more vibrant.

Sometimes it’s the little things that have a big impact on culture. Does your sales team in headquarters ring a gong when it closes a deal? Send one to your satellite offices, too. Even your interior decorating choices have an impact. Something as seemingly trivial as workplace decor has been found to play a part in steering an office’s culture. Standardize the look and feel of your offices to create a unified workplace identity.

Technology

Feeling left out or just separate from company headquarters, satellite offices often develop a “stepchild” mentality. Leveraging the right technology makes it possible to overcome this and help foster a singular workplace culture many miles (or even oceans) away. And as a bonus, the same technology can make your organization more productive, too.

Your top-of-the-line phone system won’t cut it. Audio can only go so far; if you haven’t already, push to incorporate video into your workplace meeting habits. The impact can be dramatic: one survey found that 87 percent of remote employees felt more connected to their company through videoconferencing. If your company holds monthly or quarterly all-hands meetings, be sure to broadcast these as well.

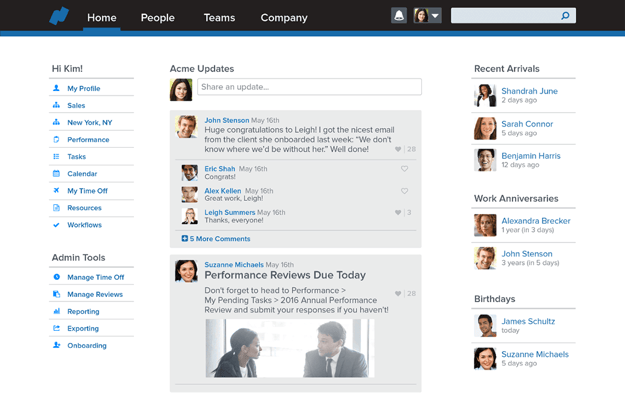

One other positive, recent development has been the blossoming of HR technology. The humble HRIS, once just a system of record, now features employee recognition, workplace perks, and even social feeds.

The latter feature can serve a variety of purposes: sharing business updates from leadership, registration reminders for the corporate volleyball team, celebrating birthdays and anniversaries, or just to share a few photos from last night’s team outing.

These tools won’t just help keep your new offices happy, they’ll also make your HR team’s general day-to-day easier. You’ll be empowered to share company-wide announcements, distribute employee handbooks, conduct open enrollment, organize performance reviews, and report on employee data in real-time. Incorporating tools like these that can help make even the largest company feel small, and there’s no better time to implement than when you’re going multi-state.

Employee Relocation

If you open up an office in Los Angeles, don’t be surprised if some of your East Coast employees start California Dreamin’. Opening up a new office elsewhere may lead some colleagues to expect a new kind of mobility. While your company policy should be influenced first and foremost by budget and business need, there are some best practices to consider.

Transferring employees is expensive: though costs vary, it’ll cost you an average of $97,000 to uproot a current employee. Relocating a new hire will cost a little less, or about $72,000. It can also take months, especially if the individual is a homeowner. Because of the high cost, most HR departments have adopted a straightforward, no-nonsense policy: “if you ask for it, you pay for it.” In other words, if the employee initiates the move to a new office for personal reasons and the move is approved, it’s up to the employee to cover those relocation costs.

On the other hand, if the company is the one asking, it shoulders most of these costs. It may be wise to draft a contract in case the employee voluntarily terminates soon after the move. If that happens, you can ensure that you recoup the costs. These so-called “payback clauses” are typically enforceable for 12-18 months after relocation.

Compensation, which is in part influenced by the cost of living, will need to be adjusted with an employee’s move. In some cases, the adjustment may seem jarring. A $100,000 salary in Manhattan might fall below $80,000 in Austin, Texas. Likewise, a move in the opposite direction could mean a significant raise—and a new consideration for your budget.

Confronted by the high costs and legal risk, many employers outsource relocation to a third party. If you’re a newly minted multi-state employer, it’s likely that you’ll go through this process repeatedly. As a result, it may be worthwhile to request RFPs from a few relocation vendors before deciding to go it alone.

Employee Handbook

Your company’s handbook is a compact between the business and its employees. Shaped by both legal requirements and HR best practice, it sets expectations and helps shape culture. Because compliance has a sizeable impact on your policies, you may be tempted to draft separate handbooks for each office, each with its own policies covering leave, wages, and other benefits. That move is tempting, but going in that direction can cause an employee relations nightmare.

Best case scenario, the decision to create separate handbooks keeps your business out of legal trouble. Worst case scenario, it fosters animosity between offices and create a dynamic of haves and have nots. While there is no “one-size-fits-all” approach to navigating multi-state HR, we recommend that when it comes to your employee handbook, one-size-fits-all is probably the right way to go. Enforcing a unified set of policies helps mitigate many of the administrative burdens and cultural pitfalls of multi-state employment.

Struggling to administer varying PTO and paid leave policies? Learn how technology makes it easy.

Set your current handbook as a baseline. At a minimum, meet with your team and identify what policies, if any, you’ll need to adjust to comply with state and local laws in the new location. You should even pay attention to laws in surrounding cities, as labor requirements are sometimes based on where the employee lives, not just where he or she works. If you need to raise the bar to meet these requirements, do so. It’ll help keep you compliant, potentially boost employee moral back at headquarters, and make you a more competitive recruiter, too.

Need help keeping your employee handbook compliant? Namely's Comply Database solution offers a Dynamic Employee Handbook tool that notifies you if employer requirements change in your area and when your handbook policies need a refresh. This powerful tool will keep your handbook up-to-date and your business covered.

HR's Opportunity

Opening a new office marks an important stage in your company’s history. To make it all possible, you’ll be asked to navigate multi-state compliance, employee recruiting, moving logistics, and more. Senior leadership will lean on the HR department more than ever to meet its objectives.

There’s a catch: HR teams are already tasked with handling a lot. Processing I-9s, reviewing payroll, and singlehandedly conducting benefits enrollment doesn’t leave much time for strategic planning. But the good news is that the right mix of technology and expertise can help you can save time on HR administration and focus on the big picture.

Becoming a multi-state employer is an opportunity for HR to reaffirm its value as a strategic partner.

The content of this publication is provided for informational purposes only and does not contain or constitute tax or legal advice. You should not act on this information without seeking tax or legal professional counsel.