Employee Benefits Guide

Employee Benefits Guide: Coverage, Deductions, Technology, and Open Enrollment

Employee Benefits Coverage

Employees expect more than ever from their companies. So what kind of employee benefits should you offer? Between medical, dental, life insurance, worker’s compensation, disability insurance, the options seem endless.

Medical, Dental, and Vision

The Affordable Care Act (ACA) requires that employers with 50 or more full-time workers offer health insurance—or face a stiff tax penalty. The “employer mandate” has made insurance a requirement, not a perk. Indeed, over 57 percent of all full time workers in the U.S. are offered employer-sponsored coverage.

To stay compliant and competitive, be sure your insurance covers the following:

- Preventative care

- Treatment of illness, disease, or accidents

- Inpatient hospital treatments

- Prescription drugs

Ancillary & Voluntary Plans

Ancillary benefits are employee offerings that don’t fall under major medical coverage. That said, they can have a huge impact in making you a more competitive recruiter. In terms of priority, offering ancillary benefits fall somewhere after medical and dental. Here are some important ancillary benefits to put on your radar:

- Life and Disability Insurance

- Retirement

- EAP (Employee Assistance Program)

- Critical Illness Insurance

- Hospital Indemnity Insurance

- Travel Assistance

What to Offer

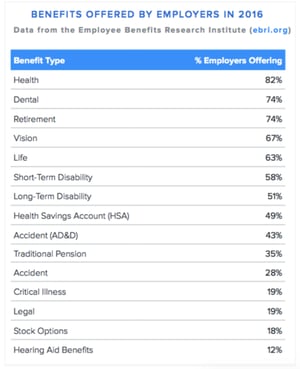

Not sure how your benefits stack up to the competition? Sometimes you just need to ask. Survey your employees annually to see how they feel about your current offerings and what they’d like to see next open enrollment. Below are the most popular offerings in the U.S.

More resources on employee health coverage:

Deductions & Contributions

It’s no surprise that employees rate cost as the most important factor when making benefits decisions. Offering competitive plans requires a balancing act between what employees want and what you can afford as an employer.

Whether or not you offer a more traditional group insurance plan, a high-deductible health plan, or another plan structure, there are many options available for helping ease the burden of cost on your employees. Plus, you can setup a benefits plan that is ultimately affordable for you. Here’s are the key issues you’ll need to be aware of.

Premiums vs. Deductibles

Premiums are the portions that employers and employees pay, often monthly, for insurance costs. The lower the total premium, the less the employer pays monthly. Deductibles are the amounts employees are responsible to pay before their insurance company begins covering expenses. In layman’s terms, the higher the deductible, the more the employee pays—and the lower the cost for your business.

In most states, companies have to cover at least 50 percent of monthly premiums. This cost is called a minimum contribution or cost-sharing percentage. Those costs can add up! According to 2018 Mercer Data, small to mid-sized employers spent an average of $12,148 per employee on health benefits. Typically, the plan will cover employees and all of their family members as well.

Nationally, benefits plans are shifting towards high-deductible health plans (HDHPs), meaning lower premiums, higher deductibles, and more financial responsibility placed on individual employees. Over 80 percent of insured workers have policies that include a deductible. Still, going along with the high-deductible trend may not necessarily be the best strategy at your company. For one, high deductibles can encourage workers to skimp on care they need. What’s more, in hyper-competitive sectors like tech you may need to invest more in your plans to catch the eye of discerning talent. Generally speaking, the more competitive your industry, the more likely you are to pay higher premiums.

Health Savings Accounts (HSA)

If you decide to implement an HDHP, there are ways to lessen the burden on employees. A popular strategy is to offer health savings accounts (HSAs).

An HSA is a medical savings account, owned by the employee, that is exempt from federal taxes. Both employees and employers can contribute to an HSA. Since 2020, the annual limitation on contributions for someone with self-only coverage with a high-deductible health plan is $3,550. For family coverage, the limit is $7,100.

Companies are also pairing HSAs with other options. A health reimbursement account (HRA) is an employer-funded health benefit plan. An employer sets an amount to contribute to the account, but only after the employee has an approved medical expense. If an employee leaves the company, he or she cannot take HRA funds with them.

A flexible spending account (FSA) is another popular, tax-advantaged financial account. The employee sets aside a portion of their paycheck to go into the account to be put towards qualified medical expenses. FSAs are not exclusive to high-deductible health plans—funds can often be used for other benefits like dependent care. As of 2018, the maximum employees could contribute to one is $2,750.

Defined Contributions

Finally, in an effort to make budgeting for group health insurance plans easier, employers may turn to defined contributions. In this case, employees are supplied with a set amount by the employer to put towards the cost of his or her care. Contributions go toward employee premiums and may be presented as a lump sum or monthly contribution.

In this approach, employees may be left to find their own health care on online marketplaces or a private exchange. While employees may appreciate the added flexibility and freedom of choice, they’ll need more support in making their plan decisions. Given this, switching to defined contributions may or may not be worth the cost savings. Be sure to consult with your broker to learn more about this model.

More resources on deductions and contributions:

- The Rise Of HDHPs

- HSA vs. FSA: Spelling Out the Differences

- Alternative Funding: How To Curb The Cost Of Healthcare

Benefits Technology

Employees today, particularly those at fast-growing or midsize companies, expect a modern benefits enrollment experience. Intuitive, modern technology is critical in fulfilling that expectation. In other words, the tools you use to administer your benefits are almost as important as the plans themselves.

Whatever technology you use, make sure that it’s easy to use for both employees and HR managers. The best software guides employees through their options with contextual help, all without relying on hard-to-understand benefits jargon. Last but not least, your technology should be self-service—empowering individuals to view or change benefits on their own, freeing up HR’s time (and email inbox.)

Because employee benefits are largely paid for through payroll deductions, consider a more integrated software to eliminate the need for dual entry. When it comes to something as sensitive as healthcare, a mis-entered number or miscommunication between systems can cause serious problems. If you can’t switch systems just yet, at the very least consult with both your benefits and payroll vendors to confirm that their technologies are compatible.

Whatever you settle on for benefits technology, keep in mind that your broker should have ready ready access to the platform as well. This provides them with deeper insights into your employee demographics and enrollment preferences, meaning you can more effectively measure future needs ahead of your next open enrollment.

More resources on benefits technology:

- Changing Benefits Brokers Is Easier Than You Think

- How Better Benefits Put All The Pieces Together

- 3 Smart Ways To Save On Employee Benefits

- Future of HR Technology

- What Are Your Benefits Costing You?

Employee Communication

What good is a world-class benefits package if you can’t get the word out? Whether you’re in the middle of a plan year or gearing up for open enrollment, communication should be a key part of your overall strategy.

Make it a habit to regularly survey employees on how they feel about their benefits, and what they might like to see added to the company’s offerings. Doing so is a great way to identify gaps that your HR team might otherwise be unaware of. Your benefits broker can be a valuable resource here, by providing you with templates and guidance.

If you’re preparing for open enrollment, communication is particularly critical. Begin crafting your strategy 3-6 months beforehand. Start by considering what might have gone well (or not so well) the last time around. What questions did employees ask most often? Was anyone surprised by what their plans did or did not cover? You’ll be able to gain deeper insights by surveying employees on how they felt about how last year’s enrollment process.

Tailoring Communications

Every company is different, so be thoughtful about how you communicate with your workforce. If large swaths of your company work on a manufacturing floor, for example, opt for face-to-face or printed communications. Conversely, if your employees spend most of their working days in front of a computer, consider leveraging non-traditional mediums like videos and webinars.

Even a tailored approach can fall flat, given that employees tend not to like talking about benefits. In fact, nearly 20 percent of employees don’t discuss their enrollment options with anyone at all. That’s why when it comes to benefits, it pays to think like a marketer; get creative with your communications.

Utilizing an intranet or company newsfeed to share regular updates is one option. Being creative might be as simple as just using attention-grabbing subject lines in your communications, or producing quirky, low-budget videos. If you have employee phone numbers on file in your HRIS, consider using an SMS alerts vendor to text them en masse—a relatively new approach that can come in handy in other instances too, like when the office closes due to inclement weather.

Leverage Events

Sometimes, a little pomp and circumstance can go a long way. Consider organizing an in-house benefits fair for employees. Make the event fun with massage chairs, raffles, and a healthy, catered lunch. Also consider making it a family event by inviting spouses and children, as they’re often beneficiaries of your plans as well. Your benefits broker may have experience organizing this type of event. In some cases, they may even be able to secure the attendance of carrier representatives—who better to have on-site to field employee questions?

You might also want to consider holding “town hall” style meetings. At a minimum, this should happen once a year for open enrollment. You should start by clearly presenting changes to your company’s plans and highlighting any new offerings. It’s a safe bet that employees will have questions, so it’s advisable to reserve at least an hour. Be sure to highlight that you’ll be available afterwards to address more personal questions one-on-one.

More resources on employee communication:

- Active Enrollment Helps You Provide The Best Benefits

- PPO Vs. HMO Vs. EPO: Spelling It Out For Employees

- What Counts As A Qualifying Life Event?

- Cooking Up A Benefits Plan

Open Enrollment

Barring a personal event like getting married or having a child, employees are permitted to change their benefits only once a year. This narrow window of time, typically lasting between 2-4 weeks, is referred to as open enrollment.

One of the most critical questions you’ll need to address is whether your enrollment period is “passive” or “active.” Passive enrollment refers to when employees do not have to take any action for their plans to renew. This is common, and like self-service technology, might mean less work on your end. That said, this approach might also mean that your employees end up ignoring the enrollment period and any new offerings you’ve made available. In 2019, only 65 percent of employees changed their benefits during open enrollment.

Conversely, active enrollment forces employees to make their selections for the coming plan year, regardless of whether they’re planning to keep the same coverage. Opting for this approach encourages employees better know their options and actually read the materials you produce. While active enrollment might be harder on the employees, it results in more informed decision making—and less surprises in the middle of the plan year.

Outside of these options, you’ll need to settle on how long to make your waiting period, or the time between when an employee signs up for a plans and the benefits actually kicking in. Waiting periods can vary among employers:

-

For example, new group health plans under the Affordable Care Act may not exceed a 90-day waiting period before employees gain access to their benefits. In addition to the 90 days, you may also take a one-month orientation period, meaning some employees may wait up to 120 days before receiving any benefits.

-

You may offer benefits to employees immediately upon hire.

-

You may offer benefits on the first of the month after 30 or 60 days of employment.

Most companies in competitive industries don’t institute a waiting period. However, if you experience high employee turnover during the first few months, the 90-day waiting period may be appropriate to avoid additional administrative costs. Look to competitors as well. If they offer shorter waiting periods to their new hires, it may be worth keeping pace with them.

More resources on open enrollment:

- Employees Want Better Healthcare, Not More Perks

- Open Enrollment Survey: What Employees Really Want

- When It Comes To Benefits Questions, Who Do Employees Trust?

- Your Post-Open Enrollment Checklist For The New Year

- How to Run Open Enrollment Like a Pro

Making It Easy

The benefits industry is rapidly changing, with new offerings and trends regularly coming to the forefront. Stay ahead by subscribing to benefits publications and surveying employees on their wants and needs. Don’t be afraid to leverage your own professional network as well, especially when it comes to best practices. Attend your local SHRM chapter’s events or attend one of these popular HR conferences.

The subject of employee benefits has always been intimidating, but it doesn't have to be. Keep a positive spin through your benefits communications and consider tying in a wellness program into the initiatives. Encouraging health holistically at your company—from health insurance to gym memberships to free healthy lunches—makes for sound employees and sound minds. Engaging your employees in benefits and providing them with the proper programs and resources ultimately leads to a healthier, happier workforce